Nio supplier CATL plans to build new power battery plant in Shanghai, Reuters reports

Nio and Tesla's battery supplier CATL is planning to build a new automotive battery factory in Shanghai, Reuters said on Thursday, citing people familiar with the matter.

The plant will be able to produce 80 gigawatt-hours of batteries per year, the report said. CATL currently has an annual capacity of 69.1 GWh, with another 77.5 GWh under construction.

A factory in Shanghai would put CATL closer to Tesla's factory in China and help it attract a more diverse pool of talent than Ningde, Fujian, where it is headquartered, the report said.

Notably, CATL is also a supplier to Nio, Xpeng Motors, and Li Auto, and has a 100 kWh battery pack line built in partnership with Nio.

The shortage of battery supply, along with the shortage of chip supply, has become the most important factor limiting the output of Chinese electric vehicle companies. But in the view of top Chinese investment bank CICC, these conditions are expected to ease in the second half of the year.

"Supply of batteries, such as the 100kWh packs from Nio's partnership with CATL, is expected to start moving higher from the third quarter," CICC said in a research note on Thursday.

If CATL builds a plant in Shanghai, it is expected to further strengthen its position as the world's largest power battery maker.

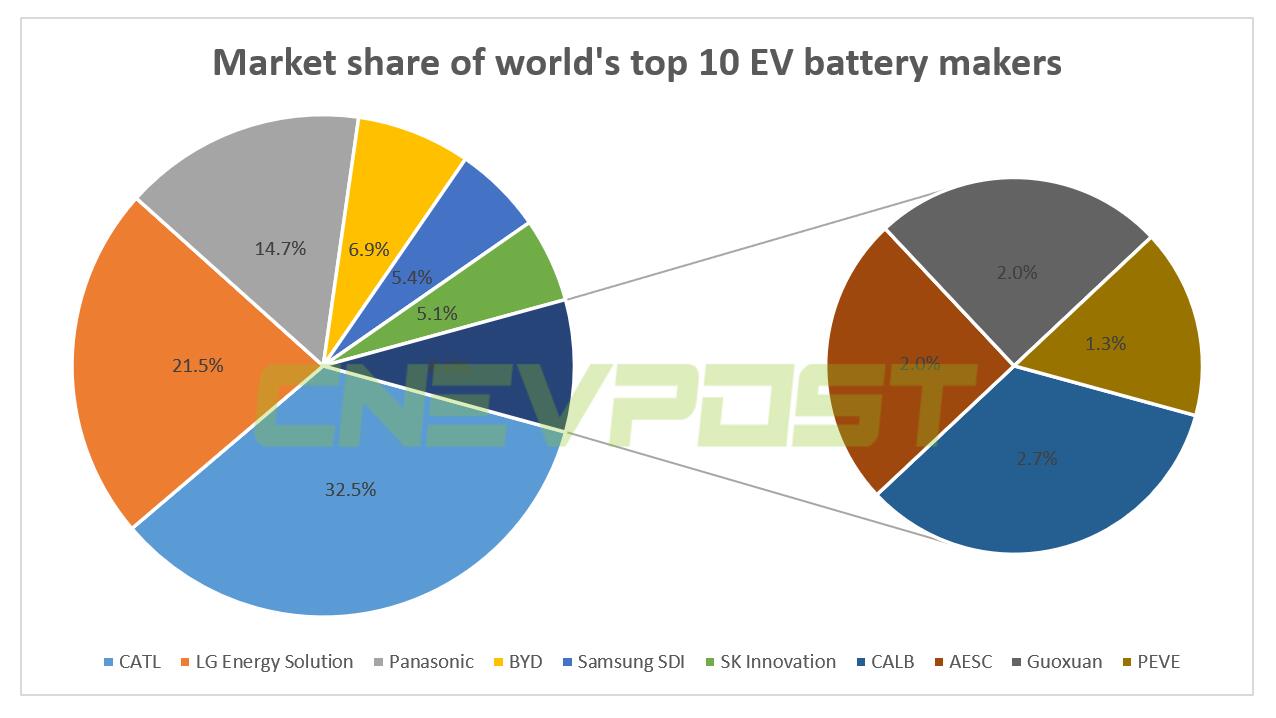

Global electric vehicle battery sales were 65.9 GWh in the January-April quarter, up 146 percent from 26.8 GWh a year earlier, market research firm SNE Research said on Tuesday.

CATL's sales almost quadrupled to 21.4 GWh, giving it a 32.5 percent market share, 10 percentage points higher than second-place LG Energy Solution's 21.5 percent, which sold 14.2 GWh in the January-April period.

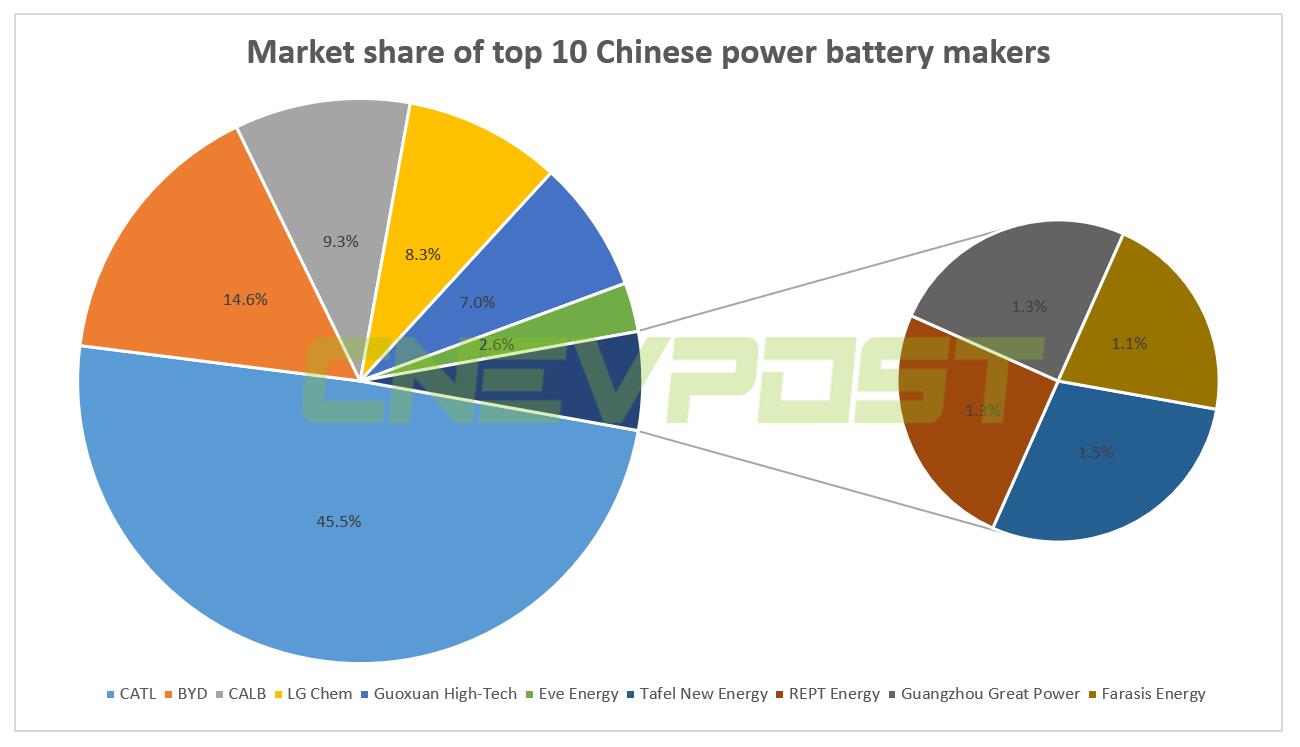

CATL, founded in 2011, is China's largest power battery supplier, with a long-term market share of about half in the country.

In April 2021, China's power battery installed base was 8.4 GWh, down about 7% from March and up 134% year-on-year, according to the China Automotive Battery Innovation Alliance.

CATL ranked first, with 3.82 GWh installed in April and a 45.5% market share.

On Monday, CATL's stock price jumped in Shenzhen trading, putting its market value at RMB 1 trillion for the first time, marking a significant moment in the development of China's new energy vehicle industry.

This makes the country's largest power battery supplier the first company in the ChiNext Index, China's NASDAQ-style board of growth enterprises, to hit RMB 1 trillion in market capitalization.