Nio, Xpeng, Li Auto stocks plunge amid broader pre-market sell-off

After Wednesday's selloff, China's electric car trio -- Nio, Xpeng Motors, and Li Auto -- continued to plunge in pre-market trading on Thursday.

At press time, Nio was down 6.39 percent to $53.50. If this decline extends into the open, it would be the company's biggest drop since January 15.

Nio fell 5.24 percent to $57.15 on Wednesday and has accumulated a 7.75 percent drop in the first three days of the week.

Xpeng fell 6 percent to $46.95 in pre-market trading Thursday. It fell 7.48 percent on Wednesday and is down a cumulative 11.4 percent for the first three days of the week.

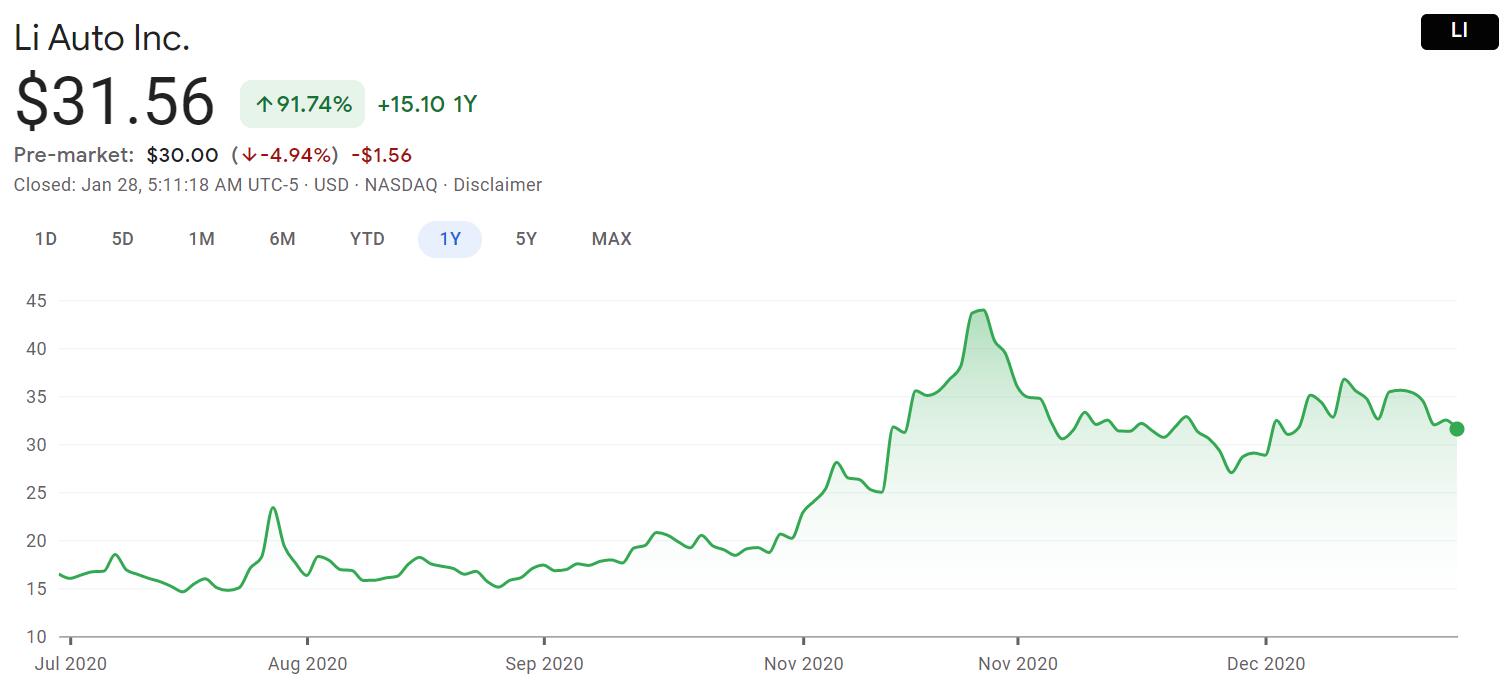

Li Auto fell 4.94 percent to $30 in pre-market trading Thursday. It fell a more modest 2.89 percent to $31.56 on Wednesday, though it has largely continued to move lower since January 20, down 11 percent in that period.

Shares of a large number of companies are currently lower in the US stock market, with Tesla down more than 6 percent pre-market and Apple down more than 3 percent pre-market, despite better-than-expected fiscal first-quarter results.

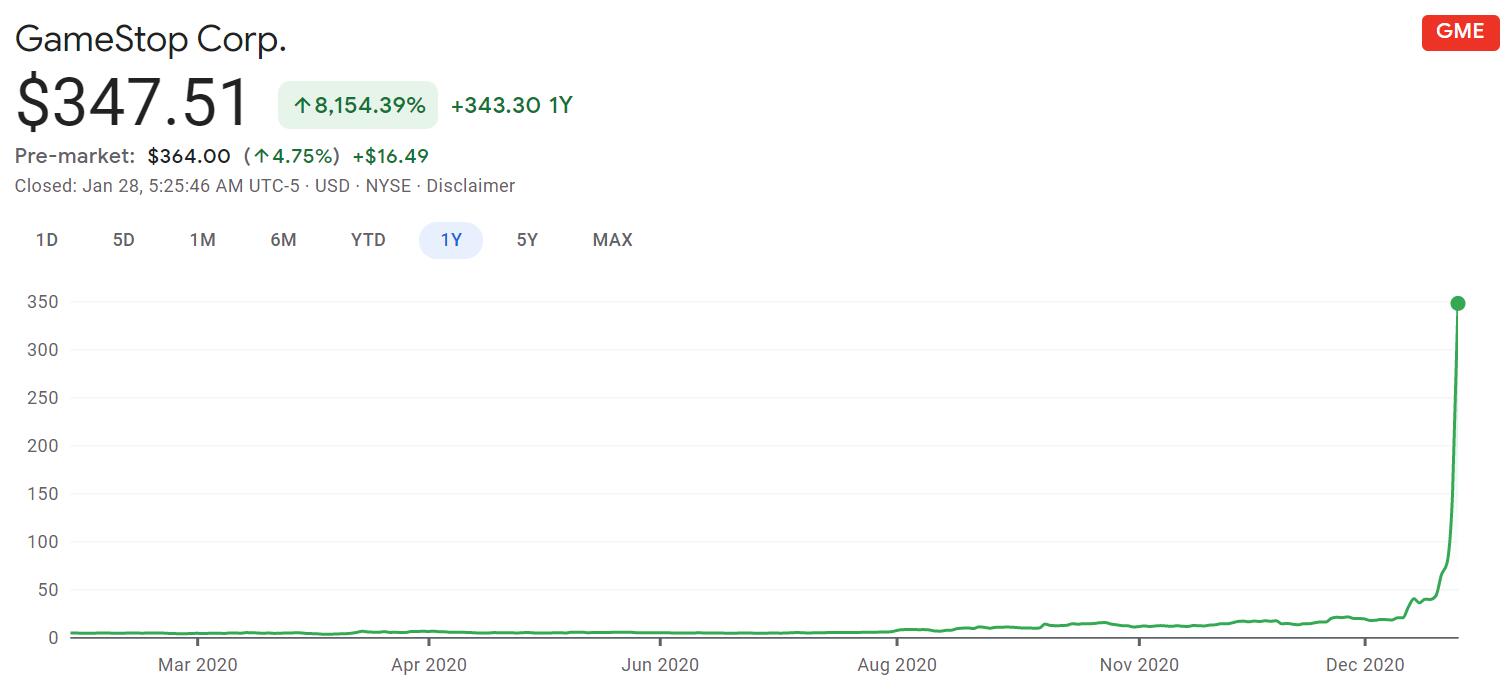

GameStop was down 13% at one point but has now turned up 4.75%.

European stock markets have also suffered a major sell-off, with the Stoxx 600 index extending its decline to 2%.

There is no immediate cause for the stock market selloff, but some events should be noticed.

The Federal Reserve kept interest rates unchanged at this month's FOMC meeting on Wednesday and kept the current size of bond purchases unchanged.

Fed Chairman Jerome Powell said that the Fed can take more action in asset purchases if necessary.

For investors highly concerned about the issue of tapering the strength of asset purchases, he said it is not the time to discuss a specific date.

GameStop closed up nearly 135 percent on Wednesday, accumulating a 1,642 percent gain in the two weeks since January 13.

Powell was asked what he thought of the surge in GameStop shares, though he said he would not comment on individual stocks or the day's market performance.

A White House press secretary said Biden's team is monitoring GameStop, and AmeriTrade informed subscribers that there will be limits on some GameStop and AMC-related trades.

Separately, as of Tuesday, US hedge fund managers had closed short positions for a fourth straight session while cutting long positions, Bloomberg reported.

Data aggregated by Goldman Sachs' institutional brokerage business unit showed that their total outflows from the market during the period reached their highest level since October 2014.

The Goldman Sachs Hedge Sector VIP ETF, which tracks hedge funds' favorite stocks, fell 4.3% on Wednesday, its worst day of performance since last September, with all but one of the stocks it tracks closing lower on Wednesday.

Strategy analysts at Goldman Sachs Group and JPMorgan Chase all believe the US stock market will see an upturn.

Goldman Sachs chief global equity strategist Peter Oppenheimer said the recent volatility in U.S. stocks should be seen as a correction in a new equity cycle. When the market recovers again, the recovery will be led by more cyclical and value stocks.

In a report to clients on Wednesday, Marko Kolanovic of JPMorgan Chase suggested that investors should ignore warnings about a stock bubble and instead add to their positions amid a wave of market selling.