EV battery makers up the ante as competition intensifies

China's electric vehicle battery market is expected to embrace better-quality products with lower prices as the nation opens the industry to both domestic and international players, leading to fierce market competition and helping bring better batteries to the market, industry experts said.

Song Jin, a senior automobile analyst at Beijing-based market consultancy Analysys, said that currently Contemporary Amperex Technology Co Ltd (CATL) and BYD are leading the country's EV battery industry and have already taken considerable market share.

But the industry in China is at a relatively early stage and the competitive landscape is full of variables. Huge opportunities in the sector remained untapped.

"The result of market competition is that companies will increase technological investment, and bring about better products with lower prices. Plus, given the Chinese government's favorable policies, China's EV batteries will have a stronger competitive edge in the world," Song said.

On March 29, Shenzhen, Guangdong province-based BYD unveiled a new blade-shaped battery. The product belongs to the lithium-ion phosphate (LFP) battery family. Unlike the traditional LFP battery, it has a longer life and the ability to record a higher mileage.

As the blade-shaped battery solved the short run time of an LFP battery, industry experts said it will help redefine standards and promote sustainable development of the industry.

On June 10, CATL said its new super battery is likewise ready for mass production. The battery is capable of powering an electric vehicle for 2 million kilometers and has a life of 16 years. That is far better than current EV batteries, which can run for 250,000 kilometers and have a maximum life span of eight years.

Zhang Xiang, an automobile analyst at the new energy and intelligent connected car industry think tank under the Ministry of Industry and Information Technology, said BYD's blade-shaped battery increased its energy density by raising the space utilization of the battery pack, enabling EVs to run for a longer distance.

To showcase the safety of the blade-shaped battery, BYD took and passed the nail penetration test, the most rigorous and critical method to test battery safety, and disclosed the results of the whole process to the public.

"The nail penetration test of a single cell is included in the national EV standard. EV batteries should meet the standard in order to reach the safety criteria. BYD has explained the theory of its blade-shaped battery in detail to the media, enabling the public to understand the new product better. However, CATL disclosed few information about its super battery. The public hardly knows how it works," Zhang said.

The actual function of the batteries remains to be tested by the market, he added.

BYD said that "Han", its C-Class car and the first EV that carries its blade-shaped battery, will be launched by the end of June. CATL did not say when its super battery will come to the market.

Data from automobile new media EVobserver showed that CATL and BYD account for roughly 59 percent of the EV battery market share in China.

With the country's opening-up policy, international brands are now entering the market.

In July 2018, United States electric carmaker Tesla launched its gigafactory in Shanghai. Producing an entire EV on its own, Tesla aims to completely localize its China supply chain.

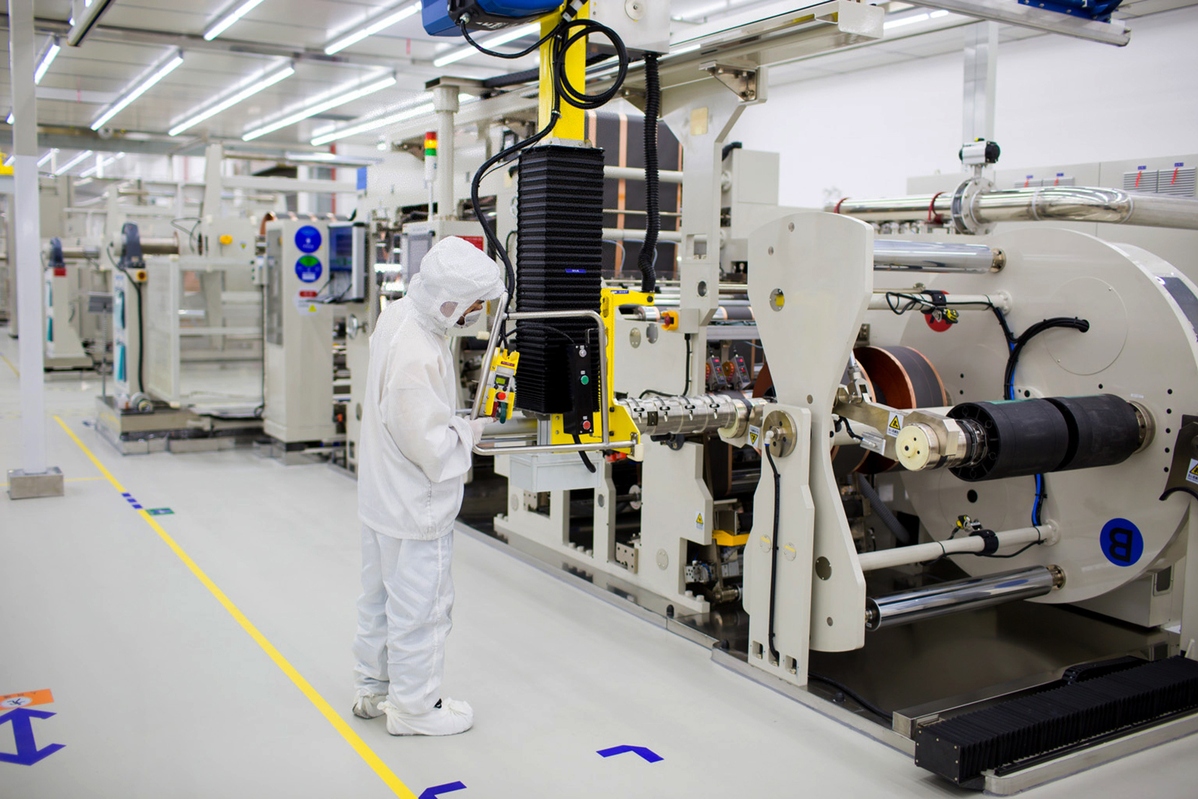

Many international companies had also set up EV battery factories in China because of its favorable investment policies.

In December 2015, Japan's Panasonic Corp announced plans to establish a lithium battery factory in Dalian, Northeast China's Liaoning province. The factory officially started delivery of its products in March 2018.

LG Chem, South Korea's biggest chemical maker, said it will expand its battery factories in China this year. In October 2015, the company launched its first battery factory in the country in Nanjing, Jiangsu province.

The MIIT's guidelines on the industry required new EV sales to take up 25 percent of total new car sales by 2025, which means the EV market will expand by six times, delivering vast opportunities in the EV battery sector, Song said.

"Fierce market competition is expected in China, as more opportunities and government's favorable policies are within sight," Song said, adding better products with lower prices will come along and bring more benefits to consumers.