AR head-up displays to become commonplace in vehicles

Head-up displays, or HUDs, have been a feature reserved for premium vehicles until very recently. But their application is expected to grow in an explosive way in coming years, as the technology is combined with augmented reality, according to experts.

"The AR-HUD is now applied in around 1 percent or even less of new cars, but the figure is expected to grow to 5-to-10 percent in 2023," said Guo Ning, a senior executive in charge of products at Beijing ASU Tech Co.

Originally invented for military aviation, the HUD projects data on the windshields so the pilot does not have to look down to check parameters. In the 1980s, General Motors introduced the technology into vehicles to improve road safety.

There are several kinds of HUDs, and the most popular one is the windshield-HUD, or the W-HUD. The AR-HUD is gaining momentum as a much more powerful alternative because of its combination of reality and data.

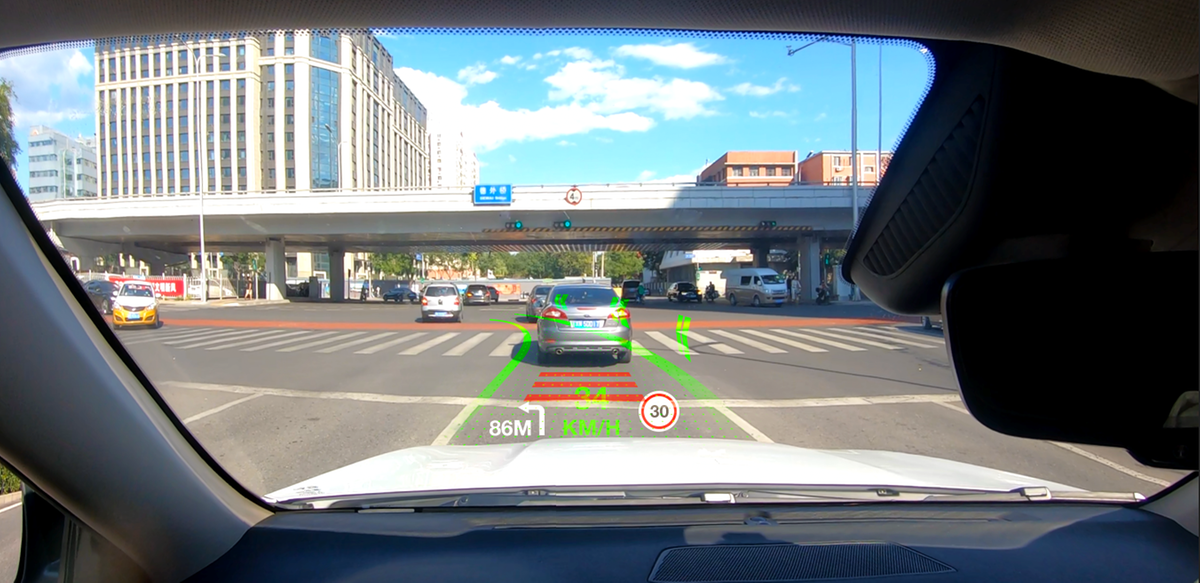

Based on real-time sensor data, such information as advanced driver assistance system alerts and navigational cues are projected into the driver's field of view.

By placing graphics directly in the driver's line of sight that interact with and augment real world objects, AR-HUDs can significantly improve driver situational awareness.

Mercedes-Benz became the first carmaker to use the AR-HUD, when it debuted the flagship S sedan in September 2020.

Volkswagen is to use the technology in its ID.3 and ID.4 electric vehicles as well. Many Chinese and international carmakers are expected to follow suit.

Guo said the space required for AR-HUDs used to be a hindrance. For example, the one used in the Mercedes-Benz S class sedan needs a space of up to 12 liters.

Companies in the segment are making progress. ASU's latest-generation device, which is under development, requires no more than 7.5 liters, thanks to the liquid crystal on silicon technology.

Products using the technology have better performance as well, including a wider field of view and a high level of brightness.

ASU is working with Chinese vehicle brands and plans to talk to international car makers as well.

The rise of Chinese companies in the sector are helping cut costs as well, which has been dominated so far by international companies including Germany's Continental and Japan's Denso.

Statistics from industry website Vzkoo show that of vehicle models available in the Chinese market, there were around 780 with the W-HUD or the older C-HUD.

The market in 2020 was estimated to be worth around 6.56 billion yuan ($1.01 billion), up 300 percent from 2019.

The sales figure is expected to grow to 24.48 billion yuan in 2025, at an annual growth rate of over 50 percent. The AR-HUD is expected to see its share grow to 20 percent by the year.