Hopes for hydrogen as China to tackle carbon

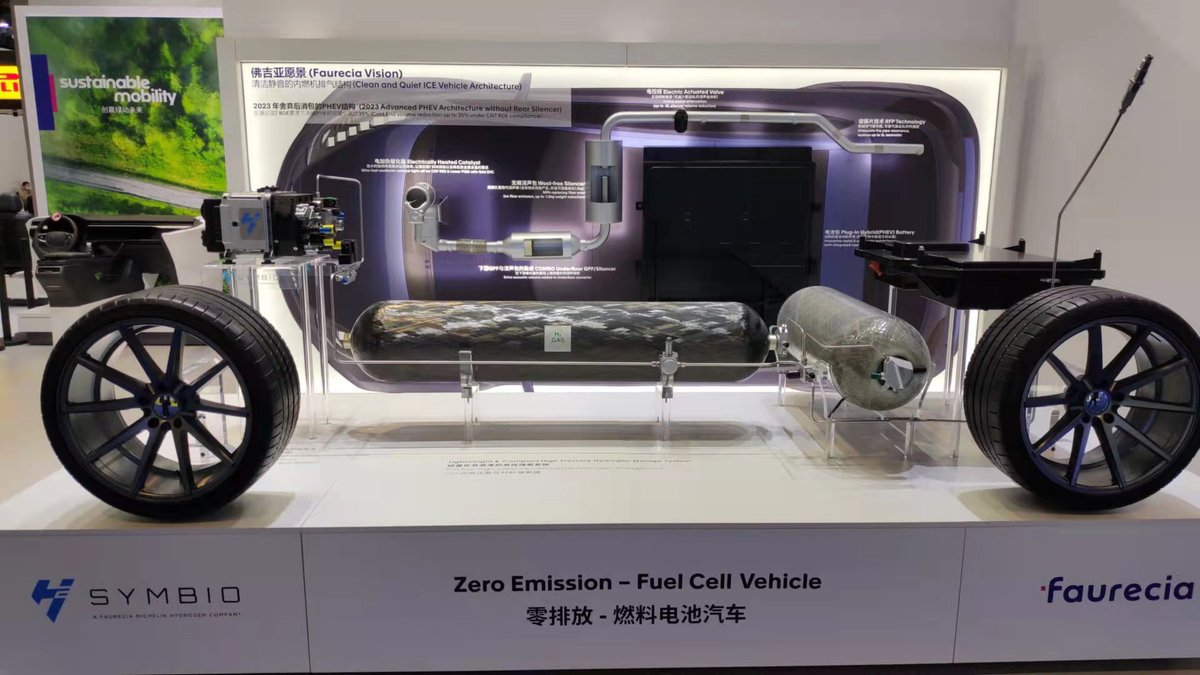

Hydrogen fuel cell vehicles are expected to experience a rapid expansion thanks to new global environmental goals, according to insiders and experts, who also acknowledge difficulties on the road to commercialization.

In terms of developing new energy vehicles, electric and hydrogen fuel cells are regarded as the two major technologies. However, the development of hydrogen vehicles is lagging compared with the global market containing millions of EVs.

Statistics show that by the end of 2020, there were only 32,535 hydrogen fuel cell vehicles worldwide. The situation is not optimistic in China, which has the largest number of NEVs.

According to the China Association of Automobile Manufacturers, in 2020, the production and sales of hydrogen fuel cell vehicles in China were 1,204 and 1,182 respectively-and all of them were commercial vehicles.

In the same year, the production and sales of electric vehicles in China were 11.1 million and 11.15 million, up 5.4 percent and 11.6 percent year-on-year respectively.

As China put forward its dual carbon goals-peaking carbon emissions before 2030 and achieving carbon neutrality before 2060-hydrogen fuel cell vehicles are expected to welcome a period of evolution, according to insiders and experts.

Hydrogen and fuel cells can help with decarbonizing and reducing emissions. This is a main route for the transformation of China's energy and transportation and the realization of the dual carbon goals, said Chen Xuesong. He is president of FTXT, a hydrogen fuel cell product manufacturer of Great Wall Motors, China's largest sport utility vehicle producer.

South Korean vehicle maker Hyundai announced in September that it will launch a range of new commercial vehicles, including hydrogen fuel cell buses and heavy trucks. It aims to be the first automaker in the world to equip all its commercial models with hydrogen fuel cell systems by 2028.

The company is committed to make its hydrogen fuel cell vehicles comparable in price to electric ones by 2030, to ensure market competitiveness, according to Hyundai.

German auto parts supplier Bosch expects about one in eight newly registered commercial vehicles globally to be fuel cell ones by 2030. It made the forecast in a statement last week announcing its cooperation with Italian technology company OMB Saleri in developing hydrogen storage products.

Hydrogen will be an important component of future hybrid powertrains to achieve climate neutrality, said Uwe Gackstatter, president of the Bosch Powertrain Solutions Division.

Between 2021-24, Bosch plans to invest about 600 million euros ($679.68 million) in automotive fuel cells and 400 million euros in stationary fuel cells for power generation and heating.

In China, spurred by the dual carbon goals, each level of government has issued policies to encourage and support the development of hydrogen fuel cell vehicles. Statistics show that more than 40 Chinese cities have introduced policies to promote the development of hydrogen energy.

Liu Wei, secretary-general of the National Alliance of Hydrogen and Fuel Cell, said that the dual carbon goals are a driving force for the development of hydrogen energy industry, and China's hydrogen energy industry is entering a new chapter.

The alliance estimated that by 2050, China's demand for hydrogen energy will reach 60 million metric tons, which is expected to help reduce 700 million tons of carbon emissions.